Understanding Landlord Insurance: Coverage and Benefits Explained

Introduction and Outline: Why Landlord Insurance Matters

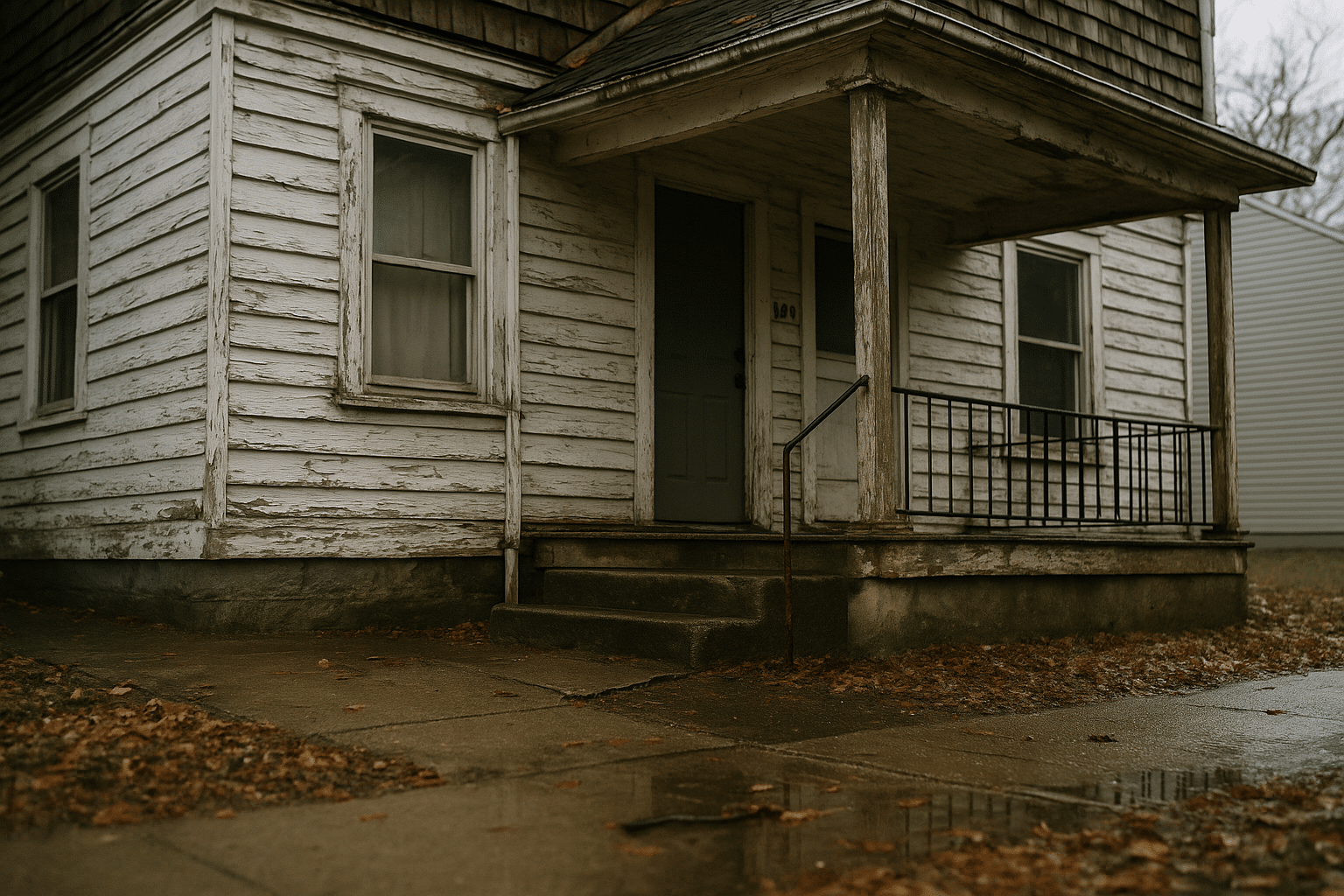

When you shift from homeowner to landlord, your risk profile changes in ways that are easy to underestimate. A standard homeowner policy is designed for owner-occupied living, while a landlord policy assumes frequent tenant turnover, different maintenance obligations, and exposure to claims from people who do not own the property. That seemingly small distinction ripples through everything: which perils are covered, how lost rent is treated, what counts as your property versus the tenant’s, and who pays legal costs if someone gets hurt on the premises. In short, landlord insurance is about managing the financial dynamics of a rental business, whether you own a single condo or a small portfolio.

This article sets the stage with an outline and then dives deep into each part of the policy. We’ll explain coverage for the building and attached structures, compare “named-peril” and “open-peril” approaches, and show how deductibles and sub-limits affect your out-of-pocket costs. We’ll unpack liability—what happens if a guest slips on broken stairs, a contractor alleges injury, or a neighbor claims damage from a plumbing mishap. We’ll clarify property protection, distinguishing the structure you insure from the tenant’s belongings you generally do not. Finally, we’ll connect all the pieces with cost drivers, claim examples, and selection tips that help you avoid common gaps.

Here’s the roadmap you can expect as you read:

– Coverage: what the base policy typically includes for the dwelling, other structures, and loss of rental income

– Liability: how bodily injury, property damage to others, and legal defense are handled—and where exclusions hide

– Property: which items you own can be insured, the difference between replacement cost and actual cash value, and how endorsements can fill gaps

– Cost and Claims: what moves premiums, how to document losses, and ways to reduce risk without cutting critical protections

You’ll find practical examples throughout—like how a kitchen fire is adjusted under open-peril coverage versus named-peril coverage, or how water backup endorsements can rescue a claim that would otherwise be denied. Where data helps, we use ranges that reflect industry norms: for example, landlord policies often cost about 15%–25% more than otherwise comparable homeowner policies because rentals present greater uncertainty. The tone is actionable: by the end, you should understand what each policy component is supposed to do, how to tailor limits to your rental, and how to evaluate trade-offs with eyes wide open.

Coverage: Structure, Perils, Loss of Rent, and the Fine Print

Coverage for landlords typically centers on the dwelling itself—think walls, roof, built-in systems—and may extend to other structures like detached garages or fences. Policies commonly come in “named-peril” forms (covering only listed causes like fire, wind, or vandalism) and “open-peril” forms (covering all risks except those expressly excluded). The choice matters when you file a claim: under named-peril coverage, you must prove the loss stems from a listed cause; under open-peril, the burden shifts to the insurer to show an exclusion applies. For many rentals, open-peril coverage on the dwelling is prized for its broader scope, though it may cost more.

Another pillar is loss of rent (often called “loss of use” or “fair rental value”). If a covered event—say, a kitchen fire—makes the property uninhabitable, this feature can reimburse the rental income you would have received during repairs, subject to limits and time frames. Limits are frequently set as a percentage of the dwelling limit or a specified monthly cap. The right number depends on your local market and how long repairs may realistically take; complex restorations or supply chain delays can stretch timelines, making more generous limits practical.

Common exclusions deserve close attention: flood and earthquake usually require separate policies; wear and tear, maintenance issues, and long-term seepage are typically excluded; and ordinance or law costs (bringing an older property up to current code after a covered loss) may be limited unless you add an endorsement. Endorsements can also address water backup from sewers or drains, equipment breakdown for mechanical systems, and expanded coverage for landlord-owned appliances.

Practical checkpoints when evaluating coverage:

– Identify your policy form: named-peril or open-peril for the dwelling

– Confirm loss-of-rent limits and the maximum period of restoration

– Review exclusions that correlate with your property’s age, location, and systems

– Consider endorsements for ordinance or law, water backup, and equipment breakdown

– Align deductibles with your cash reserves; higher deductibles lower premiums but raise out-of-pocket costs

Example: A windstorm damages a roof and a detached shed. With open-peril dwelling coverage and included “other structures,” both repairs may be covered, minus your deductible. Without adequate loss-of-rent coverage, however, weeks of downtime could still strain your cash flow. The nuance is the policy’s architecture: broad perils plus smart add-ons can turn a distressing event into a manageable business interruption rather than a cash crisis.

Liability: Bodily Injury, Damage to Others, and Legal Defense

Liability coverage is the guardrail between an accident and a lawsuit draining your rental income. It typically applies when a third party—tenant, guest, delivery person—claims bodily injury or property damage arising from your premises or operations as a landlord. Think slip-and-fall on icy steps, a loose handrail that fails, or property damage in a neighbor’s unit due to a burst pipe originating in your rental. Limits often start around $300,000 and commonly reach $1,000,000; some landlords add a personal or commercial umbrella for additional protection above the base policy.

A valuable feature is the duty to defend: the insurer provides or pays for legal defense for covered claims, which can be costly even if you ultimately prevail. Be mindful of whether defense costs are inside or outside the liability limit; coverage that pays defense costs in addition to the limit preserves more of the limit for settlements or judgments. Medical payments coverage, usually with a small limit, can cover minor injuries without assigning fault, reducing the odds of disputes escalating.

Exclusions and conditions are where surprises lurk. Claims arising from intentional acts are excluded. Professional services (such as managing other properties for a fee) may be excluded unless specifically added. Certain animal-related incidents may have restrictions, and short-term rentals can trigger different rules. If you perform structural work yourself, the policy may treat that as a higher-risk activity; using licensed and insured contractors is often a wise precaution. Additionally, contractual liability—obligations you assume in leases—may be limited. It’s prudent to have lease clauses reviewed so you do not promise indemnities your insurance will not honor.

To strengthen your liability posture, focus on prevention:

– Maintain safe egress: sturdy handrails, well-lit stairs, even walkways

– Document inspections and repairs with timestamps and photos

– Install and test smoke and carbon monoxide alarms according to code

– Require tenants to report hazards promptly and in writing

– Use licensed, insured vendors for electrical, plumbing, and structural work

Example: A guest trips on a broken step and fractures an ankle. Liability coverage could fund defense and a settlement, subject to the deductible and policy terms. If your policy includes medical payments, it may handle initial medical bills swiftly, reducing friction. In contrast, absent maintenance records, a simple claim can look like negligence, making both the legal and financial outcomes more severe. Good records and habitually safe conditions complement liability coverage, turning a volatile risk into a manageable one.

Property: What You Own, How It’s Valued, and Common Gaps

Property protection in landlord insurance divides into two big buckets: the building (structure and permanently installed systems) and your personal property used for the rental. The building includes walls, roof, plumbing, electrical, and major fixtures. Landlord-owned personal property might include appliances you provide (stove, refrigerator), window treatments, and lawn equipment used to service the property. Importantly, the tenant’s belongings are not covered under your policy; tenants should carry their own renters policy to protect furniture, electronics, and clothing.

Valuation options significantly affect claim outcomes. With replacement cost coverage, the insurer pays to repair or replace with similar new materials, without deducting for depreciation. With actual cash value (ACV), depreciation is subtracted, which can dramatically reduce a payout on older roofs, flooring, or appliances. Many landlords favor replacement cost for the dwelling because it aligns better with real reconstruction needs. For personal property you own, consider whether replacement cost is available and appropriate based on item age and value.

Another dimension is inflation guard and ordinance or law coverage. Building materials and labor can spike unexpectedly; inflation guard adjusts coverage over time to track cost trends. Ordinance or law coverage helps pay for code-required upgrades after a covered loss—such as adding hardwired smoke alarms or upgrading electrical panels—costs that basic coverage may not fully address.

Gaps that commonly surprise new landlords:

– Tenants’ property: not covered under your landlord policy

– Gradual damage: rot, rust, or long-term leakage is typically excluded

– Flood and earthquake: usually require separate policies

– Water backup: often excluded unless endorsed

– Vacancy clauses: coverage can change if the property sits vacant beyond a set number of days

Example: A supply line bursts while tenants are at work, soaking the kitchen and damaging your provided refrigerator. The dwelling coverage addresses floors and walls; your personal property coverage addresses the refrigerator; loss-of-rent coverage addresses downtime during repairs. If you only carried ACV, the refrigerator payout might be modest due to depreciation, while replacement cost would fund a like-kind new unit. The difference underscores why valuation terms deserve as much attention as limits.

Costs, Claims, Comparisons, and Smart Policy Selection

Costs for landlord insurance vary by location, property age, construction type, and rental pattern. As a broad range, many landlords find premiums run about 15%–25% higher than comparable homeowner policies because tenant-occupied dwellings present more variables: unfamiliar occupants, less direct oversight, and turnover. Older wiring, outdated roofs, or proximity to wildfire or severe winds can nudge premiums higher, while protective devices—monitored smoke detectors, water shutoff sensors, and deadbolts—can help. Choosing a higher deductible trims premium but increases your financial responsibility for smaller claims.

Comparing policies is easier with a checklist:

– Dwelling limit: aligned with current reconstruction costs, not market price

– Perils: open-peril on the dwelling when available; named-peril where budget or eligibility dictates

– Loss of rent: sufficient limit and realistic restoration period

– Valuation: replacement cost on dwelling; consider replacement cost on eligible landlord-owned property

– Endorsements: ordinance or law, water backup, equipment breakdown, and other risks tied to your building’s age and systems

– Liability: limits that reflect your assets and risk tolerance; consider an umbrella for added protection

– Vacancy and tenant type: understand rules for extended vacancy and any conditions for short-term or student rentals

The claim process rewards preparation. Keep an inventory of landlord-owned items with photos, serial numbers, and purchase dates. Document routine maintenance (roof inspections, gutter cleaning, HVAC service). After a loss, mitigate further damage (shut off water, board windows), then notify your insurer and gather estimates. Provide clear timelines and rent records to support loss-of-rent claims. Good documentation shortens disputes and can speed payment, especially when adjusters juggle high claim volumes after regional events.

Balancing cost and coverage is part art, part math. Start by protecting the big exposures—reconstruction costs, liability, and loss of rent—then fine-tune with endorsements that match your property’s vulnerabilities. For example, a basement unit might make water backup a priority, while an older structure might justify robust ordinance or law limits. If you manage multiple rentals, standardizing deductibles and endorsements simplifies administration and avoids accidental gaps created by inconsistent policies.

Final thought: a landlord policy is more than a contract; it’s the backbone of your rental’s financial resilience. Choose coverage that acknowledges real-world delays, code upgrades, and legal complexity. With clear limits, evidence-ready records, and attention to exclusions, you position your rental to absorb shocks and keep producing income through the unexpected.